Why you should NOT be using an IRR

- Jack

- May 4, 2019

- 4 min read

Updated: Oct 7, 2022

Simple CBA’s that compare costs and benefits in a single year are great and very effective for decision making, but they will need a little bit more for longer term or more complex projects. The next step is NPV and MIRR - not IRR - analysis.

You’ve no doubt heard the terms Net Present Value (NPV) and Internal Rate of Return (IRR) at some point in business or in your college intro to finance class, but here's a quick recap:

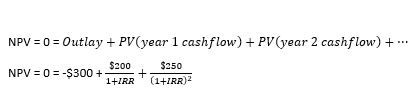

Net Present Value (NPV) is the current value (present value) of a project’s cash inflows and outflows. In other words, it values an investment you make today against the future cash the project will generate.

Internal Rate of Return (IRR) is the discount rate that makes the NPV of a project equal to zero. It's used to estimate the profitability of a project but is actually not the best way to do so.

Modified Internal Rate of Return (MIRR) is, as expected by the name, similar to the IRR in that it is used to estimate the profitability of a project, but it has modifications that make is much more accurate.

Why use MIRR instead of IRR?

I get it. IRR is what you’ve always heard since that intro to finance class in college, but just because it’s the way it’s (seemingly) always been done doesn’t make it the best method.

Here’s a summary of why MIRR is a better metric than IRR:

MIRR is more accurate and is a better comparison metric between projects. MIRR assumes that all positive cash flows from a project are reinvested at the company’s cost of capital instead of reinvesting at the project’s return in the IRR method

MIRR always has only one answer. MIRR can handle alternating positive and negative cash flows whereas IRR can have issues with changing cash flows

1) Why is MIRR more accurate?

Here is a quick example comparing IRR and MIRR.

Project Details:

Initial cash outlay (the investment) = $300

Cash flow in year 1 = $200

Cash flow in year 2 = $250

IRR – goal is to get NPV = 0

IRR is 30.5%

MIRR – need the company’s cost of capital

Cost of capital = 12%

Step 1: get all positive cash flows to the final time period, using the cost of capital

Step 2: follow the MIRR calculation

MIRR = 25.7%

The IRR calculation tends to overestimate and produce a result that is too optimistic (which could be misleading), whereas the MIRR calculation produces a more realistic answer.

In addition, you may have noticed that the IRR calculation does not use the company’s cost of capital at all. It seems like if you’re doing some corporate planning, you should at least have some consideration for the company itself, right?

MIRR assumes a reinvestment of positive cash flows into the company at the company’s cost of capital. This also means it gives you flexibility to control whatever that rate is, rather than being forced into a potentially unrealistic rate in the IRR scenario.

With the MIRR, all positive cashflows are reinvested at the company’s cost of capital, meaning when you get that $200 in year 1, you’re not just going to let it sit idle. You’ll put it back into the business for normal business operations which will grow as your business normally would by the time year 2 hits. Hence why we increased it by 12% to get it into year 2.

The IRR assumes that $200 is invested back at the same rate as the project in question (the 30.5% - rarely the case), which by extension, means that it assumes a constant growth rate across all projects in the company (even more rarely the case). Now you can see why the IRR easily over-estimates.

Using MIRR also allows you to accurately compare projects against each other by being “grounded” by the company’s cost of capital in all project scenarios. In other words, every project uses that same baseline to grow cash flows.

2) MIRR always has only one answer

In the event that there are different periods of positive and negative cashflows, IRR can produce multiple answers or error and not produce any answer, whereas MIRR always only has one result.

For example, say you have a project that produces positive cash flow in time period one (we’ll use years as the time period). Let’s say a social media campaign you create goes viral in your city and will immediately start paying you back. In year two you’re planning on investing more, but it won’t go viral, so you take a small loss in order to invest in the future.

So you’ve got positive cash flow in year one, small negative in year two, and then positive again in years three – five. There’s a good chance that IRR won’t know what to do with this and cannot produce a result. MIRR has no problem.

You may not be doing viral social media marketing, but there are plenty of real-life scenarios where cash flows can alternate between positive and negative. IRR can come out with either multiple answers or error out with no answer, whereas MIRR has a single answer every time.

MIRR is not 100% perfect though

It is important to call out the main flaw of MIRR though. It has to deal with the calculation of a cost of capital for the company. This ultimately becomes an assumption – doesn’t mean it’s incredibly difficult or impossible, but it is an assumption, nonetheless.

The ideal project comparison metrics

The best combination of comparison metrics is to use the NPV and MIRR to get an expected cash increase for the company (NPV) and what project has the most “bang for its buck” (MIRR). Both, however, do use the cost of capital (normally) which is an assumption that has heavy influence over the results.

Read more on the Cost of Capital

About Pineapple

Pineapple is a data analytics company ready to help you become data-driven! We help analyze and visualize your data in custom dashboards so you can see your full business performance at a glance, and provide analysis to drive your strategy. Our interactive dashboards will save you time, provide deeper insights & analysis, and help you make better business decisions.

Learn more about our custom dashboards:

Other Dashboards:

Comments